Expat Financial Planning: Will Your Portfolio Last Through Retirement?

Submitted by Creveling & Creveling Private Wealth Advisory on April 25th, 2016By Chad Creveling, CFA and Peggy Creveling, CFA

Once you stop earning a salary, the focus quickly turns to how you will generate an income to fund your retirement. If you're lucky, you have one of those rare corporate or government pensions. Most of us, however, are going to have to rely on social security or national pensions and whatever investment savings we have to fund retirement. For many expats who have not paid into national pensions schemes or may not be eligible, the investment portfolio will be the main source of retirement funding.

Unfortunately, many don't understand how to generate income from a retirement portfolio and are unaware of some key concepts such as sequence risk and the connection between sustainable withdrawal rates, portfolio structure, and retirement time horizon. Far too many rely on quarterly or annual returns and a focus on short-term market volatility to evaluate and make decisions about their retirement portfolios. Unfortunately, that can lead to disaster.

Running Out of Money

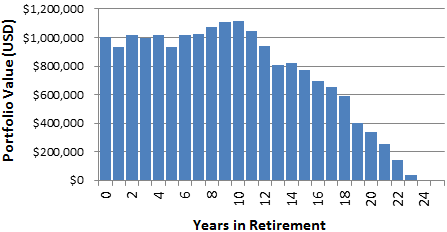

Value of USD 1M moderately allocated over a 25-year retirement (1990–2015)

USD 1M portfolio funding $65,000 annual living expenses between 1990 and 2015

Source: C&C calculations, Ibbotson portfolio and inflation data

What Matters for Making Your Portfolio Last

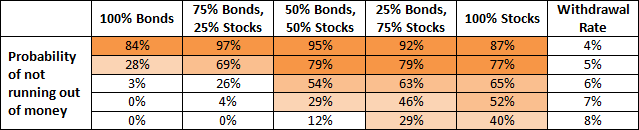

To focus on some of the key factors that do matter, Morningstar, a leading provider of financial information, looked at the impact of asset allocation and portfolio withdrawal rates on portfolio longevity. The withdrawal rate is the percentage of the initial portfolio that is adjusted for inflation and withdrawn from the portfolio each year regardless of portfolio performance. So if you have a portfolio of $1 million and a withdrawal rate of 4%, you will take out an initial withdrawal of $40,000. The next year, you will increase the $40,000 withdrawal by the rate of inflation and continue in this manner until the end of the retirement plan or you run out of money. Since you cannot predict the sequence of annual returns for your retirement period, the trick is to determine how much you can pull from your portfolio on an inflation-adjusted basis each year without running out of money.

To get a sense of this, Morningstar evaluated withdrawal rates ranging from 4% to 8% over a 25-year period across five different portfolio allocations. After taking into account historical long-run returns, standard deviations, correlations between asset classes, inflation, and expenses, Morningstar ran 5,000 Monte Carlo simulations to determine what percentage of those 5,000 simulations would have been successful. In other words, for each allocation, what is the probability of not running out of money over a 25-year retirement period?

Probability of Meeting Income Needs

Various withdrawal rates and portfolio allocations over a 25-year retirement

Source: Morningstar

You Can't Avoid Risk

There are a number of observations from the table above:

- A 4% withdrawal rate resulted in the highest probability of success (not running out of money) over 25 years regardless of the asset allocation. Of course, this assumes that the retiree diligently adhered to the targeted allocation over all 25 years and through all market conditions. Not doing so would have decreased the success rate significantly.

- 4% is not a big number. This means that you could only pull an inflation-adjusted $40,000 from a $1 million portfolio (before paying taxes) and have a high level of confidence that you will not run out of money.

- For periods longer than 25 years, a safe withdrawal rate may be closer to 3% (30% of healthy nonsmoking 65-year-olds may live longer than 25 years).

- For the most conservative allocation, the 100% fixed income portfolio, withdrawal rates above 4% resulted in extremely high failure rates.

- Adding just a little bit of equity to the allocation significantly increased the success rates (up to a point). For example, at the 5% withdrawal level, adding just 25% equity to the 100% fixed income allocation increased the probability of success from 28% to 69%.

- Higher equity levels increase the probability of success for higher withdrawal rates (up to a point). This is because the higher growth that equity provides over the longer run allows for the greater withdrawal rates. In a low-volatility, low-growth portfolio such as cash or 100% fixed income, the inflation-adjusted withdrawals quickly overwhelm any portfolio-generated growth resulting in withdrawals from principal that increase yearly at the rate of inflation. This quickly depletes the portfolio at higher withdrawal rates.

- Withdrawal rates above 6% stress even a 100% equity portfolio as the withdrawal rates overwhelm the ability of the portfolio to generate growth over a 25-year period. Periods significantly less than 25 years may be able to sustain withdrawal rates above 6%.

What's Your Sustainable Withdrawal Rate?

Many retirees mistakenly believe that they will be able to invest their retirement savings in cash and fixed income and live off the interest. The current low-interest-rate environment aside, that is not going to happen except for the very wealthy.

Generating an income stream from a retirement portfolio is a delicate balance of sustainable withdrawal rates, time horizon, and asset allocation. Unfortunately, far too few retirees understand this and instead either don't manage their portfolios effectively or focus on short-term performance metrics such as quarterly or annual portfolio returns, which have little bearing on portfolio longevity.

The table above assumes a retiree is diligently calculating a withdrawal rate each year and is following a targeted portfolio strategy through all the market ups and downs without abandoning the strategy over a 25-year period. Withdrawing too much, too often or getting spooked out of following a longer-term portfolio strategy by focusing too much on short-term volatility can significantly increase the chance of depleting the portfolio before the end of the retirement period.

About Creveling & Creveling Private Wealth Advisory

Creveling & Creveling is a private wealth advisory firm specializing in helping expatriates living in Thailand and throughout Southeast Asia build and preserve their wealth. The firm is a Registered Investment Adviser with the U.S. SEC and is licensed and regulated by the Thai SEC. Through a unique, integrated consulting approach, Creveling & Creveling is dedicated to helping clients cut through the financial intricacies of expat life, make better decisions with their money, and take the steps necessary to provide a more secure future.

Copyright © 2020 Creveling & Creveling Private Wealth Advisory, All rights reserved. The articles and writings are not recommendations or solicitations, and guest articles express the opinion of the author; which may or may not reflect the views of Creveling & Creveling.