Expat Investment Advice: The Cost of Not Sticking with Your Investment Strategy in Volatile Markets

Submitted by Creveling & Creveling Private Wealth Advisory on September 21st, 2015By Chad Creveling, CFA and Peggy Creveling, CFA

Volatile markets make for challenging times for investors. Wild swings in the market can trigger a roller coaster of emotion as investors understandably fear destruction in portfolio value and a loss of financial security. The news media, with eyeball-seeking urgency, stridency, and sense of catastrophe, serves to heighten the fear and the impetus to take action.

It's easy to succumb to fear and sell during and after market corrections in an effort to avoid further loss. Additionally, there is a sense that "savvy" investors make money actively buying and selling the markets. Despite having been decisively debunked, this type of attempt to time the market persists and unfortunately leads to an emotionally driven cycle of selling low and buying high.

Once drawn into this value-destroying cycle, many investors fail to realize the true cost to their ability to create long-term wealth.

The Cost of Bailing Out

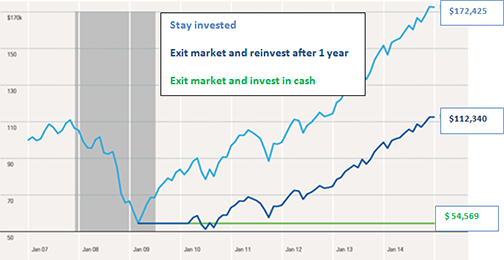

Morningstar, a leading research and investment management firm, attempted to quantify the cost of abandoning an investment strategy during times of volatility in the following chart.

The Importance of Staying Invested—Ending Wealth Values After a Market Decline

Source: Morningstar, Inc.

The chart shows a hypothetical USD 100,000 investing the stock market from 2007 to 2014, a period that encompasses the financial crisis and subsequent recovery. As the financial crisis unfolded, the market fell sharply, and at the bottom (known only in hindsight) in February 2009, the USD 100,000 was worth only USD 54,569. As the crisis and market decline unfolded rapidly, many investors were faced with steep losses in the portfolio before they knew it and had to make the decision to move to cash or risk a further decline. Since there was no sign of the crisis or market losses abating, the psychological pressure to do something to prevent further loss was immense.

For those who withstood that pressure and stayed with their investments, the market and the portfolio rebounded over the next 70 months to a new high of USD 174,425. For those who exited in February 2009 and stayed out of the markets for the next year, not believing the market recovery was genuine or rooted in economic reality, the portfolio rebounded to USD 112,340. And for those who threw in the towel, vowing never to go near the market again, they ended up with USD 54,569, or a permanent loss of USD 45,431.

The difference in ending wealth based on different decisions made at the depth of the financial crisis and market decline is staggering. For those who stayed the course, their ending wealth was USD 62,085 more than those who sold and waited a year to get back in and USD 119,856 over those who sold at the bottom and never got back in.

Construct an Investment Strategy You Can Live With

Strong market rebounds tend to follow sharp market corrections, but the depth and duration of market corrections and recoveries can vary. The only constant is that the start of the decline and the subsequent recovery are unpredictable and known with certainty only in hindsight. While there are no easy answers, here are a few thoughts to living with market volatility and successful investing:

- Understand that volatility is a normal part of investing. It is impossible to predict and avoid. It must be endured if you plan to invest.

- Construct a portfolio that you can live with. This means constructing a portfolio that exhibits the amount of volatility that you can psychologically and financially bear. There is no point being in an aggressive portfolio when a 5% drop in portfolio value causes so much concern that you consider selling to avoid further loss. You are in the wrong portfolio.

- Understand that returns on investments in the markets do not come evenly like earning interest on a deposit at a bank. They come in fits and starts, over a small number of days encountering temporary setbacks (sometimes significant), and only emerge for the investor in the long run.

- Use down periods in the market to add fresh funds. You will be entering at lower market levels (more attractive stock prices), which will help set you up for better longer-run returns.

- Use market volatility to tax-loss harvest or reduce concentrated positions with embedded capital gains (for example, company stock). Temporary losses in parts of the portfolio can be realized and used to offset gains in the concentrated position while improving the risk and return profile of the portfolio.

While devising a good investment strategy and sticking with it is generally the road to success in investing, like any rule there are times to break it. If your situation changes such that your current investment strategy no longer makes sense for you or it is clear that you are in the wrong portfolio, then a change is warranted. Ideally, this should occur when your situation changes, however, not at the depths of a financial crisis or market correction.

Additional Resources

Expat Investment Advice: Tips to Deal with Market Volatility

Expat Investment Advice: Don't Chase Returns, Diversify Instead

Seven Things Expats Need to Know About Investing